Appealing to the State Board of Equalization

With limited exception, a disputed assessment must first be appealed to the county board of equalization of where the property is located or it becomes final. Contact the assessor in your county to appeal to the county board of equalization.

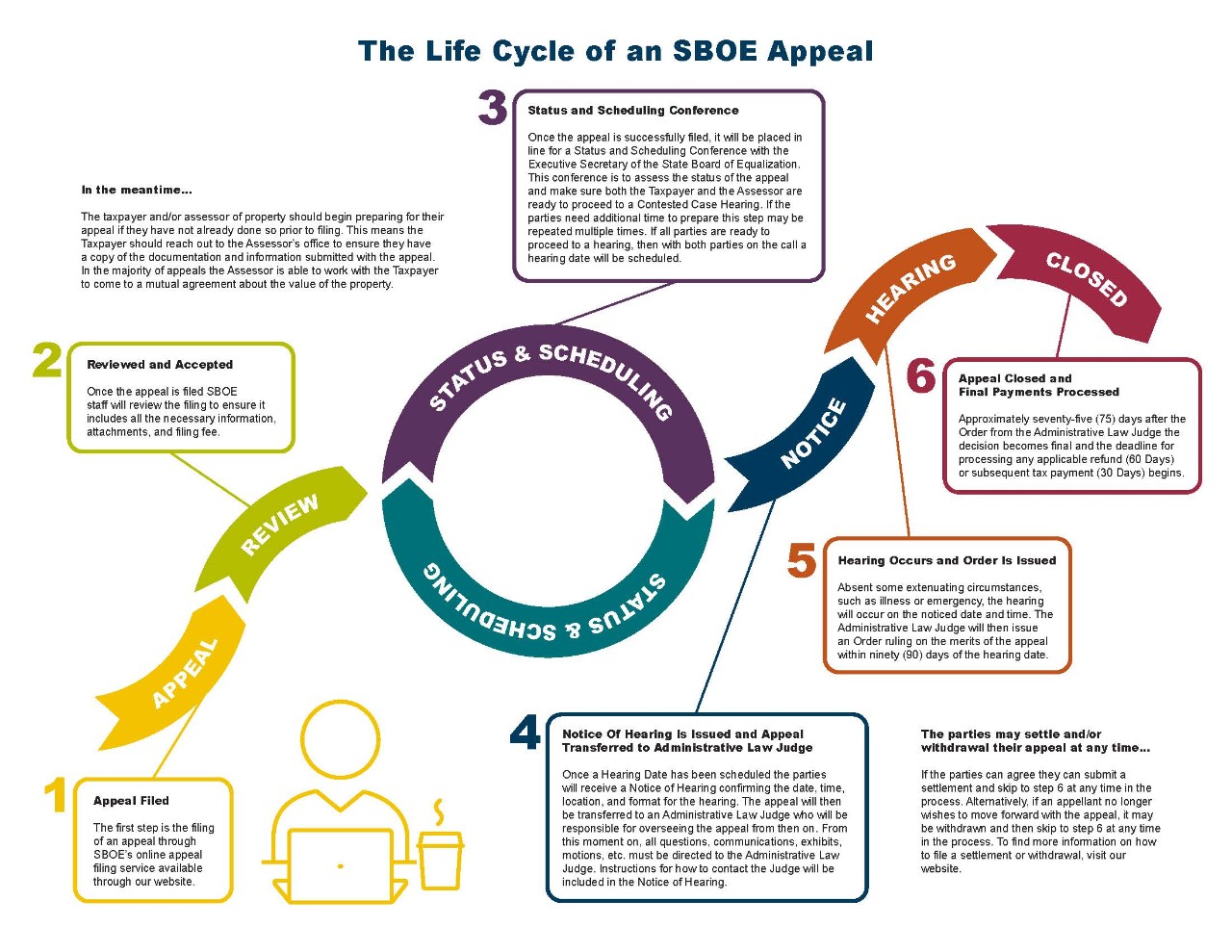

Appeals to the state board of equalization from a local board of equalization must be filed on or before August 1 of the tax year, or within forty-five (45) days of the date notice of the local board action was sent, whichever is later.

File A Value Appeal

Taxpayer's wishing to appeal a property's value to the State Board of Equalization should do so through our online filing system.

SBOE Public Portal

The SBOE Public Portal provides up-to-date information regarding the status of appeals before the board.

The County Board of Equalization:

Taxpayers must typically first appeal a disputed valuation or classification to the local county board of equalization. Some county assessors have a process for informal review of disputed assessments which may provide expedited review and correction of any contested property valuation. However, informal review is not an appeal and taxpayers must appeal to the county board of equalization should they wish to preserve their further rights of appeal.

The county board of equalization is a panel of five to seven persons empowered to hear complaints of a taxpayer and make certain changes to disputed assessments. Notice of the decision and action of the county board will be sent to the taxpayer who may accept or appeal the decision.

Hearing before an Administrative Judge:

Should a taxpayer disagree with a decision of a county board of equalization, the taxpayer may appeal to the State Board of Equalization for a hearing and determination by an administrative judge.

An Initial Decision and Order regarding a taxpayer's appeal will be issued by the administrative judge within ninety (90) days of the hearing. A taxpayer has thirty (30) days from the date the Initial Decision & Order was sent to file a written petition requesting a review by the State Board of Equalization. Otherwise, the Initial Decision & Order becomes the final decision of the State Board of Equalization.

The State Board of Equalization:

A party who desires the State Board of Equalization to review an Initial Decision & Order must file a written petition with the Executive Secretary of the State Board of Equalization within thrity (30) days from date the order was sent. Review by the State Board of Equalization is permissive and not guaranteed. Parties who petition for review by the board will be notified if their petition is granted.

Written petitions should be emailed to sb.web@cot.tn.gov and a hard copy mailed to:

Tennessee Comptroller of the Treasury/State Board of Equalization

Cordell Hull Building

425 Rep. John Lewis Way N.

Nashville, TN 37243

A copy of the written petition should also be sent to the Administrative Procedures Division of the Secretary of State's office.

Chancery Court:

A taxpayer wishing for judicial review of a final action of the State Board of Equalization must file a petition in the county where the disputed assessment was made or in an appropriate chancery court within sixty (60) days from when the order of the State Board of Equalization becomes final.

The State Board of Equalization is tasked with reviewing assessments and decisions made by local boards of equalization. Any taxpayer or any owner of property subject to taxation in the state, who is aggrieved by any action taken by the county board of equalization has the right to appeal to the State Board of Equalization. A taxpayer or owner of property must first make a complaint and appeal to the local board of equalization unless an exception provided by law allows otherwise.

Direct appeals to the State Board of Equalization without first appealing to the county board of equalization are allowable if:

- The taxpayer or owner has not been duly notified by the assessor of property of an increase in the taxpayer's or owner's assessment or change in classification as provided for in Tenn. Code Ann. § 67-5-508.

- Notice of an assessment or classification change pursuant to Tenn. Code Ann. § 67-5-508 was sent to the taxpayer's last known address later than ten (10) days before the adjournment of the local board of equalization.

- The taxpayer can show reasonable cause, meaning circumstances beyond the taxpayer's control, for the taxpayer's failure to first appeal to the county board of equalization.

- The taxpayer is appealing a correction made by or refused by the county assessor.

- The local assessor has given written consent for the taxpayer to appeal Industrial & Commercial classified property directly to the State Board of Equalization, as provided for in Tenn. Code Ann § 67-5-1412(b).

The State Board of Equalization does not have jurisdiction to accept an appeal from a taxpayer after March 1 of the year subsequent to when the time for appeal to the state board began to run.

The law requires that you pay at least the undisputed portion of your taxes prior to the delinquency date to avoid penalties and interest. You also must pay the full amount of any delinquent taxes due against the property for prior years. See Tenn. Code Ann. § 67-5-1512(b). By so doing, you avoid the usual penalty and interest for delinquent taxes and the possible delay or dismissal of your appeal. When a final certificate of assessment is issued by the State Board of Equalization, the taxpayer will owe the amount of any underpayment of taxes, along with interest at the rate provided by law.

To calculate the undisputed portion of taxes, subtract the value you claim in good faith to be the fair market value for your property, from the assessor’s value, and multiply the result times the applicable tax rate. For more information about calculating your taxes owed see "How to Calculate Your Tax Bill." County taxes for the year under appeal may be obtained from the office of county trustee. City taxes (if any) may be obtained from the city collecting official, who may be either the city treasurer, city recorder, or the county trustee, who sometimes also serves as the city tax collector.

The interest rate applicable to taxes under appeal is the composite prime rate published by the Federal Reserve Board, minus two points. (available below).

Decisions of an administrative judge or the State Board of Equalization are only final once further opportunity for agency review has concluded. The time period for further review differs depending on what level the appeal is. If no party appeals a decision, the typical periods are as follows:

- Initial Decisions and Orders of an administrative judge are typically final thirty (30) days from the date of the signed order.

- Orders of the State Board of Equalization are typically final as of the date they are issued.

Once a decision becomes final, the parties will receive an e-mailed notice from the State Board of Equalization and the results will be available on the SBOE Public Portal. Additionally, any delinquency penalty and interest postponed during the pendency of an appeal shall begin to accrue thirty (30) days after any decision becomes final.

Public Chapter 691 of 2014 abolished routine issuance of paper "official certificates" of SBOE action in appeals. Instead the Board will post actions via the SBOE Public Portal and send e-mail notifications to taxpayers, assessors and trustees as new postings occur effective July 1, 2014. Therefore, please provide this office with and maintain an updated email address for this purpose. This means significant savings in mailing and handling costs, but also may change how you close records of appeals.

Assessors may continue to certify appeal revisions to their collecting officials if this is your present practice, as a means of assuring the collector has an accurate basis to refund or collect tax due following the appeal. Collectors who have used the State Board certificates as the sole basis for further refund or collection may use the posted State Board actions instead, perhaps allowing a routine lag time to allow the assessor to review the postings for error. If you detect an error in a posting, send your correction request to Shirley.Marriott@cot.tn.gov for counties beginning with A - R and Rhonda.Wright@cot.tn.gov for counties beginning with S - Z and include the following information:

· Record

· Number

· County Name

· Tax Year

· Correction Description

· Business or Appellant Name (under which the original application was filed)

· Final Result Date

Please call (615) 401-7883 if you need additional assistance.

While an appeal is pending the parties (usually the Taxpayer and County Assessor) may agree to settle a matter before the board. Parties who wish to settle a disputed assessment should submit an Order of Compromise and Settlement in which they stipulate the assessment for the property under appeal.

By submitting a settlement, the parties do not have to go through a hearing and they forgo any further appeal or reconsideration process.

An Order of Compromise and Settlement becomes the final action of the State Board of Equalization once it is signed and sent to the parties. A copy of the results in the form of an Official Certificate will be issued pursuant to Tenn. Code Ann. § 67-5-1512, enabling the appropriate collecting official to process any applicable payment or refund of taxes due.

For additional information or to submit an Order of Compromise and Settlement for a pending appeal before the State Board of Equalization, please email sb.web@cot.tn.gov.

If your appeal has been transferred to the Administrative Procedures Division (“APD”) for assignment to an Administrative Judge, follow the filling guidelines for APD on their website (link below).

A taxpayer may request to withdraw an appeal before a decision has been entered on the primary issue of the complaint and appeal. A taxpayer who withdrawals their appeal, also waives their right to further appeal or for reconsideration.

When the taxpayer submits a withdrawal request, the board will issue an Order of Dismissal, which becomes the final action of the State Board of Equalization. After the action has become final an Official Certificate will be issued pursuant to Tenn. Code Ann. § 67-5-1512, enabling the appropriate collecting official to process any applicable payment.

For additional information or to submit a withdrawal, please email sb.web@cot.tn.gov.

If your appeal has been transferred to the Administrative Procedures Division (“APD”) for assignment to an Administrative Judge, follow the filling guidelines for APD on their website (link below).